Tive and the Business of Making In Transit Loss Measurable

Most logistics losses are not sudden failures but gradual deviations that go unnoticed until value is destroyed. Tive instruments the shipment itself, allowing companies to detect risk early, intervene in transit, and avoid the catastrophic costs of spoilage, delay, and rejection.

Ocado Technology and the Economics of Building a Fully Automated Fulfillment Network

Ocado Technology built one of the most capital-intensive and automated fulfillment systems in retail. By replacing labor-driven picking with software-controlled robotics, it reshaped grocery ecommerce economics where margins are thin and reliability is critical.

Flexe and Why Warehousing Has Become a Software Problem

Fixed warehouse networks struggle in volatile demand environments. Flexe treats warehousing as variable capacity, allowing brands to reposition inventory, reduce carrying costs, and scale fulfillment without long term leases or idle infrastructure.

Netradyne and Why Trucking Has Quietly Become an Insurance Optimization Problem

Rising insurance premiums and nuclear verdicts have turned trucking into a risk optimization business. Netradyne converts driver behavior into structured safety data, allowing fleets to reduce crashes, stabilize insurance costs, and prove active risk management to insurers, brokers, and courts.

Leaf Logistics and Why Predictable Transportation Networks Reduce Inventory More Than Forecasting Ever Will

Excess inventory is often blamed on poor forecasting, but transportation uncertainty is a larger driver. Leaf Logistics treats freight capacity as a forward market, allowing shippers to stabilize lanes, reduce lead time variability, and lower safety stock. This article examines how transportation predictability reshapes inventory economics.

Fleetworthy and why compliance has become a survival business in trucking

Most trucking companies do not fail because freight disappears. They fail because compliance gaps, rising insurance costs, or audit failures compound faster than revenue. Fleetworthy is building infrastructure that treats safety, documentation, and regulatory readiness as continuous operations, reshaping how carriers survive in an increasingly high-liability trucking environment.

Icarus Robotics and Why Inspection Is the Most Underrated Cost Center in Logistics

Icarus Robotics is using autonomous aerial inspection to reduce downtime, safety risk, and hidden infrastructure costs inside warehouses. This case study examines the economics of inspection, why uptime matters more than movement, and how continuous visibility is reshaping logistics operations.

ZIPLINE AND THE NETWORK DESIGN BEHIND THE MOST ADVANCED AUTONOMOUS DELIVERY SYSTEM IN THE WORLD

Zipline is not a drone company. It is a full network operator building fixed air corridors, high frequency docks, precision delivery droids, and airline style dispatch. This article breaks down the infrastructure, cycle time economics, and city level use cases behind the world’s most advanced autonomous delivery network.

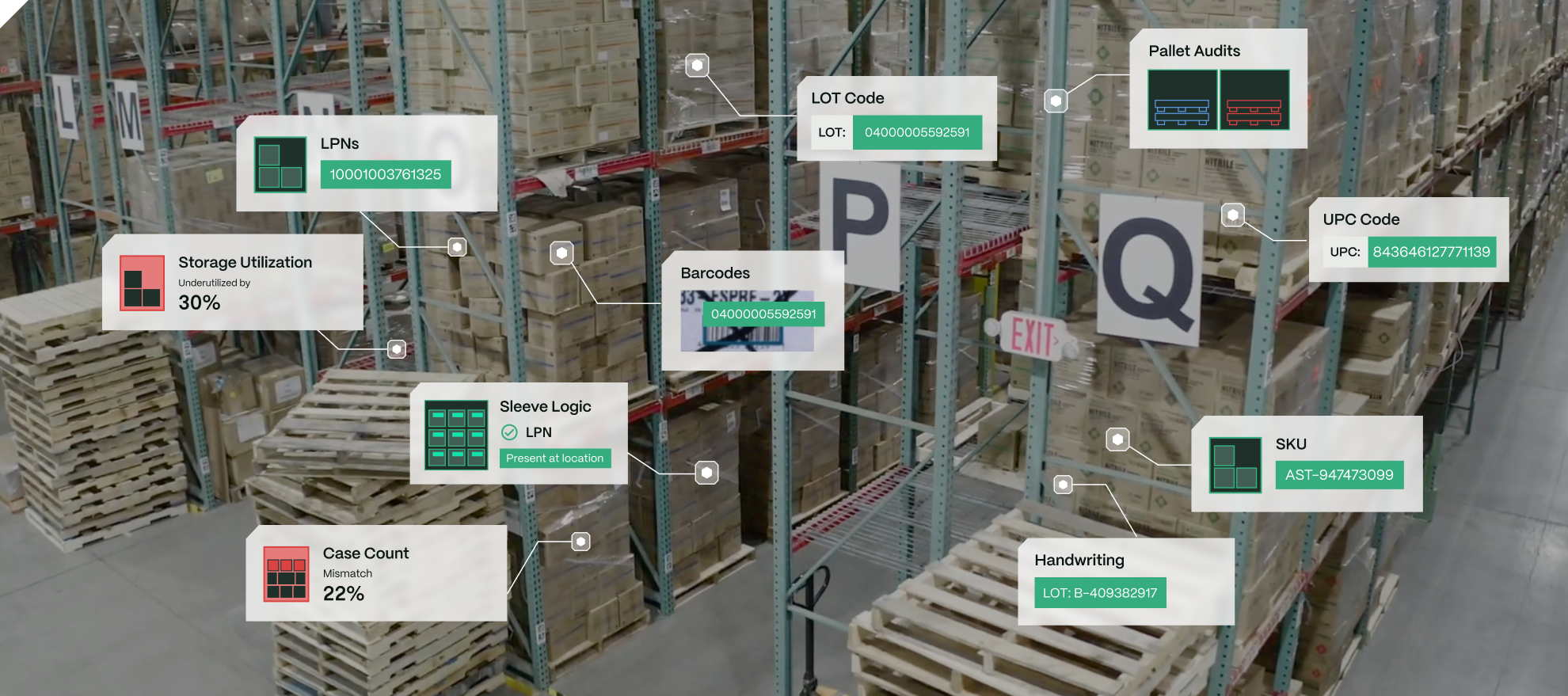

Gather AI and Why Inventory Accuracy Has Become a Network Design Problem

Inventory errors cost supply chains billions each year by inflating safety stock and breaking planning systems. Gather AI replaces manual cycle counting with autonomous drones, turning inventory accuracy into a continuous, high-frequency data stream that improves capital efficiency and network reliability.

The Coming Shift to Subsurface Logistics and How Pipedream Could Redesign Urban Delivery at the Infrastructure Level

Pipedream Labs is building an underground delivery network that bypasses traffic, cuts last mile costs, and reshapes urban logistics. This deep dive explores the economics, engineering, and case studies showing where subsurface delivery could work and why cities may need it sooner than expected.

Inside Outrider and the Automating of the Most Neglected Mile in Logistics

Outrider is automating one of the most inefficient and overlooked areas in logistics: the yard. With more than 260 million raised and a robotics stack built for electric terminal tractors, the company is proving that predictable trailer flow can reduce labor costs, shrink dwell time, and stabilize network rhythm across large DCs.

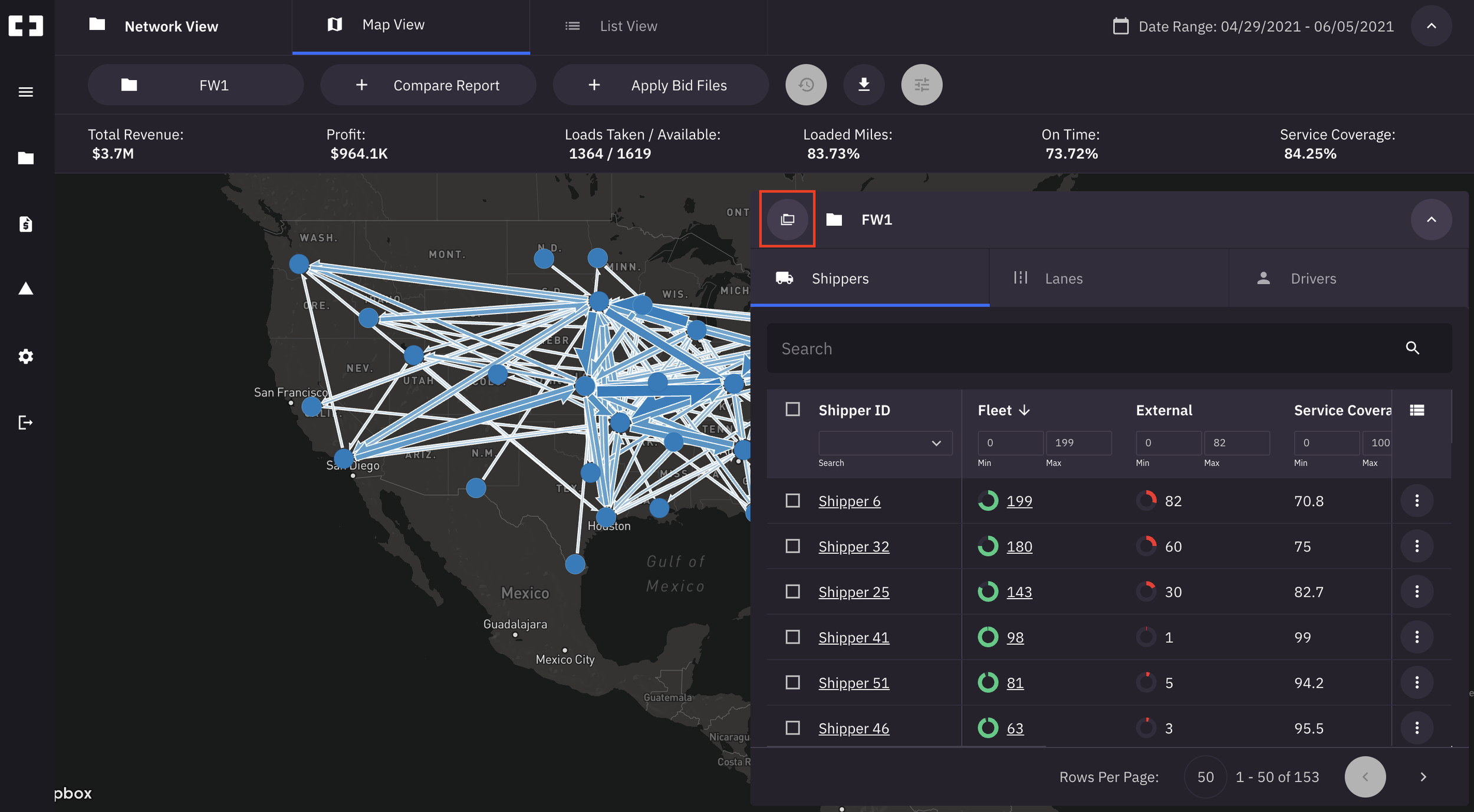

Inside Optimal Dynamics and the Future of Autonomous Freight Planning

Optimal Dynamics is trying to solve trucking’s most expensive problem: deterministic planning in a volatile market. With operating costs above 2 dollars per mile and empty miles often exceeding 18 percent, OD’s probabilistic engine aims to reduce uncertainty, improve utilization, and reshape how carriers make decisions at scale.

Inside Baton and the Economics of Relay Networks in Truckload

Baton did not fail because the relay model was flawed. It proved the math works. The challenge was density, coordination, and timing in a fragmented trucking market. This analysis examines the economics Baton uncovered and why the relay concept remains one of the most important unsolved problems in modern freight.

Inside Pickle Robot’s Quiet Push to Automate the Warehouse Floor

Pickle Robot is quietly attacking one of the most costly manual jobs in logistics: unloading trailers. With parcel volumes rising toward 30B units and warehouse turnover exceeding 40%, Pickle’s high-throughput robotic systems offer a direct path to higher dock productivity, lower labor spend, and safer warehouse operations.